Excellence in Digital Banking 5.0 2025- International Summit

Posted on 2025-11-26 08:00:00

Posted on 2025-11-26 08:00:00

Chief Risk Officer,Monzo Europe

Vice President Bank-to-Bank Partnerships Sygnum Bank AG, Switzerland

Global Head of Tech Strategy ING, Netherlands

Managing Director EMEA Financial Services Google, UK

CEO & Chairman Saldo Bank, Finland

Senior Manager, IT- Digital Banking & Platform Development Credit Europe, Netherlands

Manager Financial Crime & Sanctions Compliance Department Bank of Cyprus

Head of Digital Banking BBVA, Germany

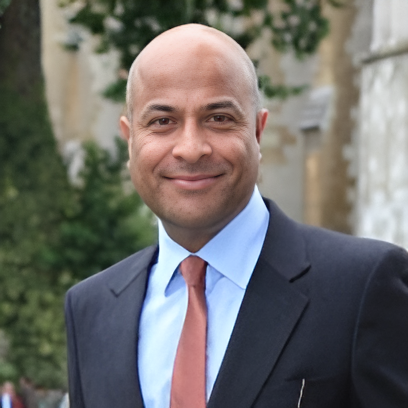

Executive DirectorJP Morgan, UK

Cheif Digital Officer, ABN AMRO Netherlands

Head of Cyber Risk Intelligence, Insider Technology Risk and Digital Asset Risk BNP Paribas, UK

Anti-Financial Crime Quality Assurance Team Lead N26

Managing Director SWIFT, Spain

Director of Sales and Distributional Channels mBank, Czechia

Chief Operating Officer ClearBank Europe, UK

VP Solutions & Data Architect Barclays, UK

Conversational Ai and Xft GenAi Rabobank, Netherlands

Transaction Managment, DZ bank Germany

Head of GenAI Center of Excellence ING, Nedherlands

Director of Emerging Solutions for Mastercard Identity Mastercard, Netherlands

Head of Compliance, SEB luxembourg

Identifying key market drivers shaping the future of digital banking . Balancing innovation with customer trust and compliance . Strategies to stay competitive amid rapid technological change

Hanna SarrafDesigning integrated customer journeys across physical and digital channels. Enhancing the role of physical branches in a digital-first world . Using AI and automation to improve operational efficiency and satisfaction

Sai AgnikhotramThe impact of fintech disruptors on traditional banking . The rise of embedded finance and Banking-as-a-Service (BaaS) . Meeting customer demand for real-time, frictionless transactions

Marco EijsackersMeasuring the success of digital engagement strategies . Balancing personalization with customer privacy . Building long-term customer loyalty through value-driven interactions

Mark RydquistData as the center of bank operations and systems . Platform banking . Embedded technology democratizing access to credit

Jarkko MaensivuFrom Legacy to Leading Edge: A Real-World Digital Banking Transformation Story

Ulas ErginUsing real-time data to anticipate customer needs and market trends . Enhancing risk management and fraud detection through predictive analytics . Leveraging customer insights to develop innovative products and services .

Niki CharilaouMaintaining customer trust while adopting new digital models . Overcoming challenges in shifting to a digital-first strategy . Integrating customer feedback into digital transformation plans

Luis Fiestas de FuentesIn an increasingly digital-first world, businesses must rethink customer onboarding and KYC processes to deliver seamless, secure and regulatory compliant experiences that drive trust and conversion. At the same time, embedded finance offers a powerful opportunity to integrate financial services directly into digital platforms, creating new revenue streams and enhancing customer value. Together, these innovations can provide a significant edge in a competitive landscape.

Sadeque AhmedUsing voice and facial recognition for secure, frictionless logins . Improving accessibility for customers with disabilities . Increasing security through multi-layered authentication

Jorissa NeutelingsMonitoring real-time transaction data for suspicious activity . Using machine learning to detect anomalies and prevent breaches . Implementing automated responses to security threats .

Jules Ferdinand Pagna DissoEnhancing payment security with tokenization and encryption . Reducing false positives in fraud detection . Improving cross-border transaction security .

Marcella VerdessiIntroducing self-service kiosks and digital advisory tools . Training staff to use AI and data insights for personalized service . Enhancing branch efficiency through automated customer support

Delgado SusanaOffering real-time customer support across physical and digital channels . Allowing seamless transitions between in-person and online services . Creating unified customer profiles for consistent experiences .

Tomas ReyttBuilding customer confidence with clear data privacy policies . Leveraging blockchain and decentralized identity for enhanced security . Giving customers greater control over their personal data .

Ezequiel CanestrariOperationalising AI: Turning Infrastructure, Data, Code, Models, and Human/AI Experience into Business Value

Amit NandiUpskilling employees to work alongside AI and automation . Automating repetitive tasks to improve efficiency . Developing AI governance frameworks to ensure ethical use

Aart MiedemaReducing loan approval times with AI-driven risk assessment . Automating document verification and fraud checks . Enhancing credit scoring models with machine learning insights

Ulrich LoofIdentifying market opportunities and customer trends . Enhancing decision-making through predictive analytics . Improving customer segmentation and targeting .

Farzam FanitabasiCreating dynamic customer profiles. Offering targeted financial products . Building adaptive pricing models

Dirk MourikPredictive analytics: How Al identifies customer behavior patterns to offer timely, relevant financial products Personalization at scale: Leveraging machine learning to create bespoke banking experiences Enhancing customer retention through proactive insights and tailored recommendations

Yuri Broodman